What We Do

Bridgewater Associates is a premier asset management firm, focused on delivering unique insight and partnership for the most sophisticated global institutional investors.

Our investment process is driven by a tireless pursuit to understand how the world’s markets and economies work — using cutting edge technology to validate and execute on timeless and universal investment principles.

Founded in 1975, we are a community of independent thinkers who share a commitment for excellence. By fostering a culture of openness, transparency, and inclusion, we strive to unlock the most complex questions in investment strategy, management, and corporate culture.

Latest from Bridgewater

December 8, 2025

Understanding a changing world is hard. Making decisions from those insights is what we do at Bridgewater. In partnership with Metaculus, we’re hosting a forecasting challenge that invites you to test these skills—with a $30K prize pool and potential career opportunities for top performers. Get in the Game.

November 26, 2025

Co-CIO Greg Jensen joins Nicolai Tangen, CEO of Norges Bank Investment Management, to unpack the geo-political and economic impact of modern mercantilism, the global AI race, and how Bridgewater is building for the future.

November 26, 2025

Quick thoughts from co-CIO Greg Jensen and AIA Labs Chief Scientist Jas Sekhon on the release of Google’s Gemini 3 model and its implications for economies and markets.

November 13, 2025

As countries grapple with the US’s more mercantilist trade policy, Canada offers a window into how different economies may respond to these pressures.

October 31, 2025

Throughout our history, the Daily Observations—or what we call “the wire”—has been our way of giving our clients and policymakers a real-time view into how we’re processing the world. In celebration of Bridgewater’s 50th year, we’re sharing a selection of BDOs that highlight the people, ideas, and process behind that pursuit.

October 14, 2025

As modern mercantilism accelerates and the AI revolution unfolds, the forces shaping today’s markets are testing the economic balance. In this excerpt from our Q3 call, Co-CIO Bob Prince shares his perspective on what this means for investors navigating a world moving away from equilibrium.

October 6, 2025

With gold up around 50% year-to-date and recently rising above $4,000 an ounce for the first time, investors are asking what’s driving the move. In this recent conversation, Bridgewater senior investors unpack the dynamics behind the rally and some of the questions it raises, including whether the rally is sustainable.

October 6, 2025

Nikunj Jain, Head of Asia Research, recognized by Business Insider as a 2025 Wall Street Rising Star for redefining the future of investing.

October 1, 2025

Today, investors are mostly making use of one type of building block: the US equity market, and the handful of companies that dominate it. As strong a building block as this is, we see a wealth of opportunity in other economies and asset classes that investors—especially individuals—have hardly begun to tap.

September 22, 2025

The resting heart rate of inflation looks higher than it did pre-pandemic, with 2% more a floor than a ceiling. Investors face structurally higher inflation risks, and most portfolios remain poorly equipped to manage them.

September 27, 2025

Bridgewater opened its idea meritocracy to the world through the Forecasting the Future Challenge, drawing over 1,000 submissions from 120+ countries—and celebrated the winners live in Central Park at the Global Citizen Festival.

September 2025

Chief Legal Advisor Rick Sharma and Senior Director, Culture and Internal Communications Irma Valverde have been recognized on the 2025 Empower Executive and Rising Stars Role Model Lists for their industry leadership and efforts to foster workplace inclusion.

June 18, 2025

Co-CIO Greg Jensen shares his thoughts on how modern mercantilism—including trade policy, geopolitical risk, and capital flows—is progressing, our outlook for the US economy, building resilient portfolios in this environment, and more.

May 29, 2025

Steve Secundo has been named to Institutional Investor’s 2025 Hedge Fund Rising Stars list, which recognizes trailblazers in the hedge fund industry for their notable contributions to the field.

May 20, 2025

Forecasting the Future: A Modern Economics Challenge—invites you to dive into the evolving global economy and predict how the next era of Modern Mercantilism will transform trade, policy, and power on the global stage. In partnership by Bridgewater and Global Citizen, the challenge offers the winners receive an employment or internship opportunity at Bridgewater (pending successful completion of its interview requirements) and the top 5 predictions will receive $25,000.

April 21, 2025

In this edited version of our Q1 CIO call, Co-CIO Karen Karniol-Tambour describes how we are processing today’s radically different economic and market environment.

March 14, 2025

For the sixth consecutive year, Barron’s has recognized Karen for her expertise, influence, and leadership in the financial services industry.

March 10, 2025

For decades, America has consumed much more than it produces, financing persistent trade deficits with debt that foreign investors are happy to buy. President Trump is unwilling to accept this state of affairs. In a guest essay for the New York Times, co-CIO Karen Karniol-Tambour describes what this shift means for Europe’s economic and security paradigm, the changes that are needed, and the barriers to reform.

March 4, 2025

CEO Nir Bar Dea joins Sonali Basak at Bloomberg Invest in New York to discuss the major forces shaping today’s macroeconomic landscape, how Bridgewater is positioned to help clients adapt, the ongoing technological revolution of AI, and the important roles that meritocracy and talent play in a rapidly evolving world.

March 4, 2025

Daily Observations editor Jim Haskel sits down with head of contra-currencies Hudson Attar and portfolio strategist Alex Smith to discuss the recent gold rally and the type of diversification gold can provide.

February 20, 2025

Nir joins the “Board of Changemakers” panel at FII Priority in Miami to discuss ongoing geopolitical fragmentation, the changing macroeconomic landscape, and how Bridgewater has aligned itself to help investors navigate this challenging environment.

February 6, 2025

Energy expert Daniel Yergin sits down with Bridgewater senior portfolio strategist Atul Lele to discuss supply and demand dynamics across energy markets and their implications for investors.

January 30, 2025

Co-CIO Bob Prince discusses the gradual drift of economic conditions toward equilibrium and whether this process has room to run.

January 25, 2025

In a Fast Company piece, Deputy CIO Blake Cecil explores the meritocratic future of talent recruitment, and how Bridgewater’s approach has evolved to include innovative new methods—such as our global forecasting contest with Metaculus—for discovering exceptional talent.

January 22, 2025

Co-CIO Karen Karniol-Tambour gave an interview on Bloomberg while attending the World Economic Forum in Davos, Switzerland. During her conversation, Karen discussed the firm's global approach to investing, and how the changing global environment impacts investors. See important disclosures and other information here.

January 6, 2025

With central banks on the verge of achieving their goals—supporting stability, profits, and asset prices—global political shifts risk upsetting the balance. Our CIOs describe these dynamics and what they mean for investors.

January 1, 2025

In partnership with Metaculus, Bridgewater is sponsoring an exciting competition where participants are invited to showcase their forecasting abilities, explore potential early career opportunities at Bridgewater, and qualify for $25K in prize money. Join the contest now and learn more about our shared mission of using data and research to understand the world around us.

December 10, 2024

The Financial Times recognized Bridgewater’s legal team as one of the Most Innovative In-House Legal Teams in North America for their close support in launching AIA Labs, advancing the firm’s use of AI and machine learning to drive innovation in the investment process.

November 2024

Tracey and Jennifer were recognized in Hedge Fund Journal’s 12th annual report, showing the strength of gender diversity in the industry and at Bridgewater.

October 16, 2024

Where is AI today, and where is it going in the near future? In this video presentation, Bridgewater’s AIA Labs Chief Scientist Jas Sekhon provides a framework that can help answer those questions and resolve a key paradox that currently exists in the AI landscape.

October 2024

From October 9-10, 2024, Bridgewater Associates co-hosted the Economic Development Assembly in Abidjan, Côte d’Ivoire, in support of the World Bank’s 21st IDA replenishment, alongside partners Global Citizen and Harith General Partners.

September 30, 2024

Blake Cecil has been named to Business Insider’s 2024 Rising Stars of Wall Street list, recognized among leaders of tomorrow making notable contributions and accomplishments in the asset management industry.

September 25, 2024

In a moderated conversation, Rohit and Bob discuss how they each approach portfolio resilience at their respective organizations and the potential opportunities they see in markets today.

September 17, 2024

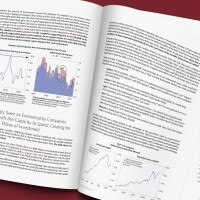

Some of the largest drivers of US equity outperformance cannot be counted upon going forward. A lot depends on the ability of US tech to deliver and AI to unleash productivity across sectors.

September 2024

As part of the 30th anniversary of the relationship between Bridgewater and GIC, the entity that is responsible for managing Singapore’s international reserves, our two organizations have led a series of joint research projects to identify and assess the issues we think are most important for investors to grapple with in the years ahead. In this videocast, Head of Client Service and Editor of the BDO Jim Haskel discusses the takeaways of that work with Jeffrey Jaensubhakij, Group Chief Investment Officer of GIC; Liew Tzu Mi, Chief Investment Officer for Fixed Income & Multi Asset and Chair of the Sustainability Committee; and our own co-Chief Investment Officer Greg Jensen.

September 10, 2024

Co-CIO Greg Jensen explains that the greatest bubbles require a transformational technology and a ripe macro and monetary backdrop. We now have both—so he believes the AI bubble is ahead of us, not behind us.

September 2024

Bridgewater hosted the Atlantic Council’s inaugural Millennium Leadership Summit at its headquarters, bringing together leaders across government, business, and civil society to discuss key trends impacting economies and markets around the world.

August 14, 2024

Ajay Banga, President of the World Bank, sits down with Bridgewater CEO Nir Bar Dea to discuss Africa’s economic trajectory and how it creates challenges and opportunities for global investors.

August 2024

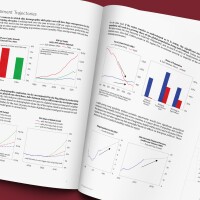

The demographic boom in the working-age population in sub-Saharan Africa is one of the long-term forces that can shape the world in the coming decades. In this research, we explore this dynamic in depth, its implications for the region’s role in the global economy, and how decisions made by policy makers, investors, and the private sector can forge alternative paths.

June 18, 2024

Throughout history, certain companies have dominated the equity market, but co-CIO Bob Prince explores how the process of creative destruction makes staying on top for long periods of time very difficult.

May 20, 2024

While AI investment isn’t yet a major driver of economic growth, co-CIO Greg Jensen says it looks poised to rise rapidly from here—with the potential to shape the business cycle well before AI is in widespread productive use.

May 7, 2024

At the Milken Institute’s 2024 Global Conference, co-CIO Karen Karniol-Tambour shares her thoughts on the macro outlook, touching on where to find geographic diversification, how we’re approaching geopolitical risk, the impact of AI on inflation, and more.

April 29, 2024

Bridgewater announces a new strategic partnership with Global Citizen that will support the World Bank’s International Development Association (IDA) fund replenishment—IDA21. By combining Bridgewater’s research with Global Citizen’s advocacy, this partnership will encourage IDA donor nations to make financial commitments ahead of an economic summit in Côte d’Ivoire from October 9-10.

April 25, 2024

As most major economies are seeing their working age populations stagnate or shrink, sub-Saharan Africa’s is growing rapidly and projected to be larger than China’s in about a decade. If the region can also increase its productivity growth, it will begin to emerge out of poverty and gradually become relevant to global investors.

April 9, 2024

With inflation stalled above target and growth remaining strong, co-CIO Bob Prince tells the Financial Times that the Fed is “off track” from cutting rates—the question is how far.

February 29, 2024

Dr. Sian Leah Beilock, President of Dartmouth College and an independent director on Bridgewater’s Operating Board of Directors, has been recognized by Diverse: Issues In Higher Education as one of the “40 Women Making a Difference in the World of Academe.” Dr. Beilock is the first woman to serve as President of Dartmouth College and is an expert in the dynamics that enable more women to pursue and succeed in STEM fields.

February 22, 2024

Bridgewater alum, author, and investor Paul Podolsky shares how he’s assessing Russia and its threat to the global order following the death of Alexei Navalny, what it takes for economies to succeed in the modern world, and the implications for investors.

December 4, 2023

Co-CIO Greg Jensen and Bridgewater’s Chief Scientist of AIA Labs and Head of Machine Learning, Jasjeet Sekhon, are named among the top "AI experts to know at some of Wall Street’s biggest hedge funds” by Business Insider. They are recognized for their distinct contributions in AI at Bridgewater and in recognition of their leading efforts for Wall Street’s AI ambitions.

November 30, 2023

What happens when cognitive tasks can be done at zero marginal costs? Co-CIO Greg Jensen explores some of the potential impacts that advancements of AI/ML technology could have on companies and the economy, including an extreme scenario that could potentially produce “explosive growth.”

November 7, 2023

Read our response to a recent book that paints a distorted and inaccurate picture of our firm and community.

October 17, 2023

Helene Glotzer will join Bridgewater’s Operating Board of Directors as a Partner Director and Jason Warner will join as an Outside Director. Helene has been part of the Bridgewater community since 2007, and Jason brings of 20 years of experience in software development, enterprise technology, executive leadership, and innovative thinking as a technologist, CTO, and business leader in the software industry.

October 10, 2023

Greg joined Bridgewater in 1996 and has long invested in the firm’s AI/ML capabilities. He joins Insider’s AI 100 list alongside Bridgewater alumnus Dave Ferrucci and other experts from the world of finance, who will likely impact the future of artificial intelligence and how it may shape our lives.

September 20, 2023

Bridgewater co-CIO Karen Karniol-Tambour joins “Bloomberg Wealth with David Rubenstein” for a wide-ranging discussion on Bridgewater’s current leadership and culture, her career journey, and our outlook on markets and economies.

June 26, 2023

Margo Cook will join Mike McGavick as co-Chair of Bridgewater’s Operating Board of Directors. Margo has been part of the Bridgewater community since 2021, currently serving as an Outside Director on our Operating Board, and brings more than 30 years of executive leadership, operating experience, and innovative thinking as an investor.

February 2, 2023

Karen joins co-CIOs Bob Prince and Greg Jensen as a full partner in leading Bridgewater’s Investment Committee and holding ultimate responsibility for our investment strategy and outcomes.

October 12, 2022

Nir describes the work required to complete a successful generational transition at Bridgewater and his vision for the firm's future across talent, culture, and business priorities.

October 4, 2022

Bridgewater celebrated the completed transfer of control from Ray Dalio to the next generation of the firm’s leadership.

February 15, 2022

Earlier this week, Ray Dalio, Bob Prince, Greg Jensen, and Co-CEOs Nir Bar Dea and Mark Bertolini signed the agreements providing for the transfer of control of Bridgewater from Ray to the Operating Board of Directors, successfully finalizing the terms of this transition.

January 3, 2022

Today Bridgewater announced that CEO David McCormick has stepped down after 12 years at the firm, including nearly five successful years as CEO. In succession, the Operating Board of Directors named two co-CEOs: current Deputy CEO Nir Bar Dea and current Co-Chair of the Operating Board Mark Bertolini.

December 28, 2021

The company’s Operating Board of Directors was announced in an email to employees.